Best crm software for private equity is essential for firms looking to enhance their investor relationships and streamline operations. As the private equity landscape becomes increasingly competitive, leveraging the right CRM tools can significantly impact a firm’s success. From enhancing communication to managing data analytics, the importance of CRM systems cannot be overstated, especially when navigating complex investor dynamics.

In this exploration, we will delve into the core features of CRM software, specifically tailored for private equity firms. Understanding how these tools can optimize operations, foster better investor relationships, and help in data-driven decision-making is crucial for staying ahead in the industry.

Understanding CRM Software

CRM (Customer Relationship Management) software plays a pivotal role in modern business operations, especially within the private equity sector. This technology not only streamlines communication but also enhances the management of investor relationships, ultimately driving growth and building trust. With the increasing competition in private equity, having an effective CRM system can set firms apart by improving operational efficiency and providing valuable insights.The core features of CRM software typically include contact management, sales management, productivity tools, and reporting & analytics.

For private equity firms, these features are essential for tracking investor interactions, managing fundraising efforts, and analyzing investor data to make informed decisions. Features such as task automation and email integration help teams maintain constant communication with stakeholders, ensuring timely updates and responses.

Core Features of CRM Software for Private Equity

Understanding the specific functionalities of CRM software is crucial for private equity firms seeking to optimize their operations. Here are some key features that cater specifically to this sector:

- Contact Management: This feature enables firms to maintain comprehensive profiles of investors, including investment history and preferences, ensuring personalized communication and engagement.

- Deal Tracking: CRM systems allow for the monitoring of potential investment opportunities, tracking stages of negotiations, and managing interactions with different stakeholders involved in each deal.

- Reporting and Analytics: Robust reporting tools provide insights into investor behaviors and trends, assisting in strategic decision-making and enabling firms to tailor their approaches based on data-driven insights.

- Task Management: The ability to assign tasks, set deadlines, and track progress ensures that all team members are aligned and accountable, which is critical in the fast-paced world of private equity.

- Integration with Financial Tools: Many CRM systems can integrate seamlessly with financial software, allowing for better data synchronization and a holistic view of investor profiles and fundraising activities.

Importance of CRM in Managing Investor Relationships

In the realm of private equity, managing relationships with investors is essential for success. CRM software enhances this management by providing a structured approach to handling communication and tracking interactions. Here’s why CRM is vital:

- Enhanced Communication: Consistent and organized communication fosters trust and keeps investors informed, which is foundational in building long-term relationships.

- Customized Engagement: With detailed insight into investor preferences and history, firms can tailor their interactions to meet specific needs and expectations, leading to higher satisfaction and retention rates.

- Data-Driven Insights: CRM tools enable firms to analyze investor data, identify trends, and make proactive decisions, allowing for more effective fundraising strategies.

Types of CRM Software Available in the Market

The market offers various types of CRM software, each catering to different needs and preferences within the private equity landscape. Here’s an overview of the primary types:

- Operational CRM: Focuses on automating customer-facing processes such as sales and marketing, enhancing efficiency in frontline operations.

- Analytical CRM: Emphasizes data analysis to help firms understand investor behavior and improve strategies based on data insights.

- Collaborative CRM: Facilitates sharing of information across departments (e.g., sales, marketing) to improve coordination and teamwork when managing investor relationships.

- Mobile CRM: Offers access to CRM functionalities via mobile devices, allowing teams to manage investor relationships and access data on the go, which is particularly beneficial for private equity professionals who travel frequently.

The essence of CRM software lies in its ability to centralize communication, track investor interactions, and provide insights that drive strategic initiatives in private equity.

Key Features for Private Equity: Best Crm Software For Private Equity

In the competitive landscape of private equity, choosing the right CRM software can significantly enhance operational efficiency and decision-making. Private equity firms require specialized features that cater specifically to their unique needs, including deal sourcing, investor relations, and portfolio management. This section Artikels essential features that make a CRM particularly effective for private equity.

Essential Features for Private Equity CRM

Implementing a tailored CRM in private equity should focus on functionalities that streamline processes and provide actionable insights. Key features include:

- Deal Tracking and Management: A robust CRM system must facilitate the tracking of deals from sourcing to closing, allowing firms to manage multiple opportunities efficiently.

- Investor Relations Tools: Features that support communication and engagement with investors, such as automated reporting and personalized updates, are essential for maintaining strong relationships.

- Data Analytics and Reporting: Advanced analytics capabilities enable firms to generate in-depth reports on portfolio performance and market trends, enhancing strategic decision-making.

- Integration with Financial Systems: The ability to integrate seamlessly with existing financial systems, like accounting and investment management platforms, is crucial for streamlined workflows.

- Task and Workflow Automation: Automating routine tasks and workflows increases productivity and minimizes human error, allowing teams to focus on more strategic initiatives.

Data Analytics and Reporting Capabilities, Best crm software for private equity

Data analytics and reporting are pivotal in private equity, allowing firms to make informed decisions based on real-time insights. Effective CRM systems can analyze vast amounts of data, providing the following advantages:

- Performance Analysis: By utilizing data analytics, private equity firms can assess the performance of their investments, identifying trends and areas of improvement.

- Market Insights: Access to comprehensive market data enables firms to identify emerging opportunities and potential risks in their investment strategies.

- Predictive Analytics: Utilizing predictive models helps firms forecast future trends, allowing for proactive decision-making rather than reactive strategies.

- Customized Reporting: The capability to generate tailored reports ensures that stakeholders receive the most relevant information, promoting better communication and understanding.

Integration Capabilities with Financial Systems

The effectiveness of a CRM is heavily influenced by its ability to integrate with existing financial systems used in private equity. When evaluating CRM solutions, it’s important to consider:

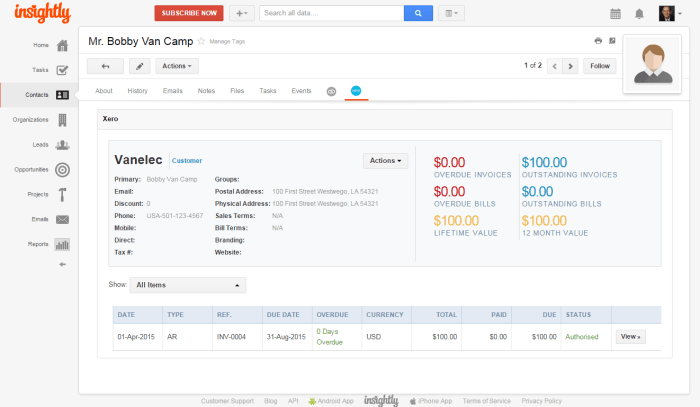

- Compatibility with Popular Financial Tools: Leading CRMs should easily integrate with tools like QuickBooks, NetSuite, or specialized private equity software, facilitating smooth data transfers.

- APIs and Custom Integrations: The availability of APIs allows firms to create custom integrations that cater to their specific workflows and operational needs.

- Data Synchronization: Real-time data synchronization ensures that all systems reflect the most current information, thereby enhancing accuracy and reducing redundancy.

- Scalability: As a firm grows, the CRM must be able to scale and integrate with new systems or tools without significant disruption.

Top CRM Software in the Market

In the competitive landscape of private equity, having the right Customer Relationship Management (CRM) software can be a game-changer. These specialized systems help firms streamline deal flows, manage investor relationships, and enhance overall operational efficiency. Below, we explore some of the top CRM software solutions designed specifically for private equity firms, highlighting their unique features and advantages.

Leading CRM Solutions for Private Equity

Understanding the unique demands of private equity, several CRM platforms stand out due to their tailored functionalities and robust support. Here’s a list of the leading CRM software solutions that cater to private equity firms:

- Salesforce for Private Equity: Known for its extensive customization options, Salesforce offers a robust platform that integrates seamlessly with other financial tools, providing a comprehensive view of investor data and deal management.

- Affinity: This CRM specializes in relationship-driven workflows, using AI to enhance networking opportunities and track relationship histories, making it an excellent choice for firms focused on investor relations.

- DealCloud: Designed specifically for capital markets, DealCloud offers powerful analytics and reporting features, helping firms manage their deal pipelines and compliance needs effectively.

Each of these platforms has its unique selling propositions that make them suitable for private equity firms.

Unique Selling Propositions

The following discusses the distinctive advantages of three top-rated CRM systems for private equity:

Salesforce for Private Equity enables firms to harness vast customization capabilities, ensuring that the CRM aligns perfectly with their specific operational needs.

Affinity leverages machine learning technology to provide actionable insights on investor relationships, allowing firms to nurture connections proactively.

DealCloud integrates advanced analytics and compliance management tools, setting it apart as a specialized solution for capital markets.

Comparison of Top CRM Systems

Below is a comparison table that highlights pricing, features, and user reviews of the leading CRM solutions for private equity firms. This table provides a clear view of how these systems stack up against each other.

| CRM Software | Pricing | Key Features | User Reviews |

|---|---|---|---|

| Salesforce for Private Equity | Starting at $25/user/month | Customizable dashboards, integration with financial tools, extensive reporting | 4.5/5 – Highly rated for flexibility and support |

| Affinity | Contact for pricing | AI-driven insights, relationship tracking, workflow automation | 4.7/5 – Lauded for its user-friendly interface and relationship management |

| DealCloud | Contact for pricing | Deal management, analytics, compliance tracking | 4.6/5 – Appreciated for its specialized focus on capital markets |

Implementation Strategies

Implementing CRM software in a private equity firm requires a structured approach to ensure a successful transition and maximize the benefits of the system. With the right strategies, firms can streamline their processes, enhance client interactions, and ultimately drive better investment decisions.The implementation process can be broken down into a series of steps that guide the firm from initial planning through to the full integration of the CRM system.

It is essential to navigate this journey carefully to avoid common pitfalls and encourage staff engagement with the new tools.

Step-by-Step Procedure for Implementing CRM Software

The implementation of CRM software involves several critical stages. Here’s a concise Artikel to follow:

1. Define Objectives

Clearly articulate the goals you want to achieve with the CRM. This could be enhancing client relationships, improving data management, or streamlining communication.

2. Select the Right CRM

Based on your defined objectives, choose a CRM that aligns with your firm’s needs.

3. Develop a Project Plan

Create a detailed plan that includes timelines, resources, and responsibilities for each stage of implementation.

4. Data Migration

Transfer existing client and investment data into the new CRM system. Ensure data integrity and compliance with privacy regulations.

5. Customize the System

Tailor the CRM functionalities to fit the specific needs of your private equity operations. This may include custom fields, reports, and dashboards.

6. Train Staff

Implement a training program to familiarize employees with the new system, ensuring they understand its features and benefits.

7. Launch the System

Go live with the CRM, ensuring all necessary resources are available to support the transition.

8. Monitor and Evaluate

After implementation, continuously assess the system’s performance and user adoption. Make necessary adjustments based on feedback and changing needs.

Best Practices for Training Staff on New CRM Systems

Training is pivotal to the successful adoption of CRM software. Effective training can bridge the gap between technology and daily operations. Here are some best practices:

Tailored Training Sessions

Offer training sessions tailored to different user roles, ensuring that content is relevant and applicable to their specific functions.

Hands-On Practice

Encourage practical demonstrations and hands-on practice in a controlled environment.

Ongoing Support

Provide continuous support post-training through dedicated help desks or user guides to assist employees as they adapt to the system.

Feedback Mechanisms

Establish a feedback loop for employees to share their experiences and challenges, which can help in refining training approaches and system features.

Incentivize Adoption

Consider implementing incentives for teams that effectively use the new CRM features to drive engagement and enthusiasm.

Potential Challenges During the Implementation Process and Solutions

While implementing a CRM system can greatly benefit a private equity firm, several challenges may arise. Identifying these challenges early can help in crafting effective solutions.

Resistance to Change

Employees might resist the new system due to comfort with existing processes. Overcome this by clearly communicating the benefits and providing ample training.

Data Quality Issues

Migrating data can lead to issues with accuracy and completeness. Ensure robust data cleansing procedures are in place before migration.

Integration with Existing Systems

Compatibility with other tools and systems may pose challenges. Conduct thorough compatibility assessments and consider phased integration.

Insufficient User Buy-In

Lack of engagement can hinder adoption. Involve users in the selection and customization phases to foster ownership and commitment.

Technical Support Gaps

Ensure that adequate technical support is available to address issues promptly during the roll-out phase, minimizing disruptions and downtime.By following these strategies and best practices, private equity firms can effectively implement CRM software that enhances operational efficiency and improves client relationships.

Case Studies of Successful CRM Adoption

Source: everhour.com

The implementation of CRM software can significantly enhance the operational efficiency and performance of private equity firms. Through strategic adoption, these firms have successfully transformed their client relationships and internal processes, leading to improved outcomes and substantial benefits. In this section, we will delve into specific case studies that highlight the successful integration of CRM systems in the private equity sector.

Case Study 1: Apex Equity Partners

Apex Equity Partners adopted a leading CRM solution to streamline their deal flow and enhance communication among stakeholders. The firm faced challenges with managing a growing portfolio and maintaining effective relationships with various stakeholders. Post-implementation, Apex reported a 30% increase in deal closures due to improved tracking and follow-ups, as well as better insights into client preferences.

Case Study 2: Horizon Capital

Horizon Capital implemented a CRM system to consolidate client information and facilitate collaboration across their teams. The firm struggled with data silos that hindered communication and analysis. After implementing the CRM, they observed a 25% reduction in time spent on client reporting and a 20% increase in client satisfaction scores, as the system allowed for personalized client interactions based on data analytics.

Case Study 3: VentureWorks

VentureWorks decided to adopt a CRM platform to enhance their investor relations and fundraising efforts. The firm experienced challenges in tracking investor communications and managing relationships effectively. Post-implementation, they reported a 40% improvement in fundraising efficiency, allowing them to raise capital faster and more effectively, which was crucial in a competitive market.

Table: Summary of Firm Experiences

The table below summarizes the experiences, challenges, and solutions adopted by the firms mentioned above.

| Firm | Challenges Faced | Solutions Adopted | Measurable Outcomes |

|---|---|---|---|

| Apex Equity Partners | Managing growing portfolio and stakeholder relationships | Leading CRM solution for deal flow tracking | 30% increase in deal closures |

| Horizon Capital | Data silos affecting communication and client analysis | CRM for consolidating client information | 25% reduction in reporting time, 20% increase in client satisfaction |

| VentureWorks | Tracking investor communications effectively | CRM for enhancing investor relations | 40% improvement in fundraising efficiency |

The successful adoption of CRM software has enabled private equity firms to not only overcome challenges but also achieve remarkable growth and efficiency in their operations.

Future Trends in CRM for Private Equity

As the landscape of private equity continues to evolve, the role of Customer Relationship Management (CRM) systems is becoming increasingly significant. With advancements in technology and changing investor expectations, private equity firms are leveraging CRM solutions to enhance their operations and investor interactions. The integration of new technologies is not just a trend; it’s a necessity for firms aiming to maintain a competitive edge in an ever-changing financial environment.One of the most significant emerging trends in CRM technology for private equity is the integration of artificial intelligence (AI) and machine learning (ML).

These technologies are revolutionizing how firms analyze data, personalize investor interactions, and enhance decision-making processes. AI and ML can automate routine tasks, analyze vast amounts of data in real-time, and provide actionable insights that were previously unattainable. This level of intelligence enables firms to predict investor behavior, tailor communications, and ultimately strengthen relationships with their stakeholders.

Artificial Intelligence and Machine Learning in CRM

AI and ML are not just buzzwords; they are integral to the future of CRM in private equity. By harnessing these technologies, firms can unlock a plethora of functionalities that enhance their operations. Key areas where AI and ML are making a substantial impact include:

- Predictive Analytics: AI-powered tools can analyze historical data to forecast future trends and investor behavior, allowing firms to make proactive decisions.

- Personalization: Machine learning algorithms can segment investors based on their preferences and behaviors, enabling firms to tailor their communications and offerings accordingly.

- Automated Reporting: AI can streamline the reporting process by generating real-time insights and analyses, which helps in monitoring fund performance and investor satisfaction.

- Risk Management: AI tools can identify potential risks by analyzing market trends and investor sentiment, thus helping firms mitigate issues before they arise.

The integration of AI and ML not only enhances efficiency but also fosters deeper connections with investors, as firms can deliver more relevant and timely information.

Mobile CRM Solutions for Enhanced Investor Interaction

The rise of mobile CRM solutions is transforming how private equity firms engage with investors. Mobility provides unprecedented flexibility and accessibility, allowing professionals to manage relationships from anywhere. The importance of mobile CRM in private equity includes:

- Real-Time Access: Professionals can access critical investor information and updates on the go, ensuring they are always prepared for meetings and discussions.

- Instant Communication: Mobile CRM solutions facilitate instant messaging and notifications, allowing for quicker responses and enhanced communication with investors.

- Enhanced Collaboration: Teams can collaborate more effectively through mobile platforms, sharing insights and updates in real-time regardless of their location.

- Improved Data Capture: Mobile tools enable professionals to capture valuable data during meetings or events, ensuring that crucial information is documented and analyzed.

As mobile technology continues to advance, private equity firms that adopt mobile CRM solutions will likely see improved investor satisfaction and stronger relationships.

“Integrating AI and mobile capabilities into CRM systems is not just about keeping up with the competition; it’s about redefining how private equity engages with its investors.”

Last Point

In conclusion, the best CRM software for private equity is not just a tool but a strategic asset that can transform how firms interact with investors and manage their operations. By adopting the right systems and practices, private equity firms can enhance efficiency, drive growth, and ultimately achieve better investment outcomes. As the market evolves, staying informed about the latest CRM trends will empower firms to navigate future challenges and seize new opportunities.

FAQ Compilation

What are the core features of CRM software?

Core features typically include contact management, data analytics, reporting capabilities, and integration with existing financial systems.

How does CRM software improve investor relationships?

CRM software helps maintain clear communication, streamline interactions, and provide personalized services to investors, enhancing overall satisfaction.

What are some popular CRM solutions for private equity?

Popular CRM solutions include Salesforce, HubSpot, and Affinity, each offering unique features suited for private equity needs.

What should firms consider when implementing CRM software?

Firms should consider user adoption, integration with existing systems, training requirements, and potential challenges during the implementation process.

How can AI enhance CRM functionality in private equity?

AI can analyze large datasets, provide predictive analytics, and automate routine tasks, leading to more informed decision-making and efficiency.